This post is the opinion of the Experimental Mommy. While compensated for my time and efforts, all opinions remain 100% honest.

As a blogger, I will say that I am having some entitlement issues with my kids. On a daily basis, the FEDEX or UPS driver stops by my home with boxes of toys, clothes or the latest tech gadget (they must think I have an online shopping addiction). Like Pavlov’s dogs, the girls come running to see what came for them in the boxes. Sounds pretty awesome, right? Most of the time, it is. But because we get previews of the latest toy or pre-teen craze, my daughters have not learned the value of these items or the money it takes to purchase them.

Recently, we started a “Ping Pong Ball Reward System” with my two daughters (ages 5 and 8) where they get to add ping pong balls to a container for doing good deeds like cleaning up the kitchen table without being asked or helping each other with a specific task. When the jar is full, they choose a “reward.” For my oldest, she almost always wants cash to purchase music or apps.

Did you know, according to TIME Magazine, that American kids get an average of $780 per year in allowance but almost none is saved? Now that my daughter is earning money, it is time to teach her what to do with it. I am so happy I found Virtual Piggy.

Virtual Piggy is the first online service that enables kids to manage, track and spend money within a parent-controlled & safe environment – plus, helps to ignite an invaluable financial literacy conversation at home.

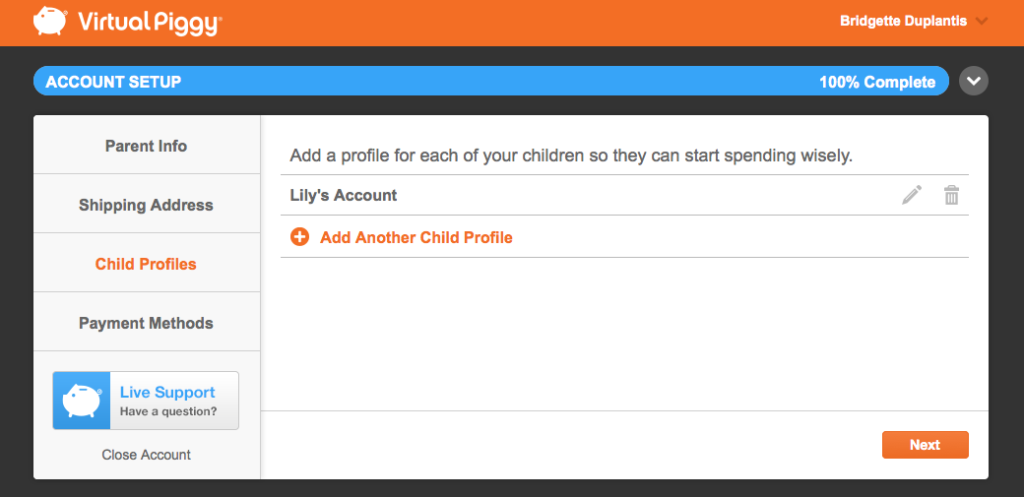

To get started, simply set up your free account. In your parent dashboard, you can add a separate profile for each child. I was able to create a username and password for my daughter so she can log in herself to check the progress of her account.

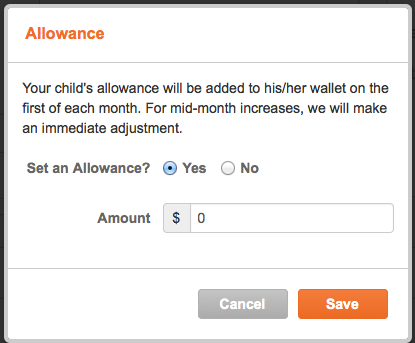

Next, you can choose to make automatic deposits in your child’s account on a monthly basis, or choose to do individual deposits. You can add your credit card or link your PayPal account from which to make deposits (but be aware that by linking only your PayPal, your child will have limited stores at which to shop). Based on our new reward system, I am only putting money in her account when she earns it. Check out all of the featured in this video including how to implement spending controls.

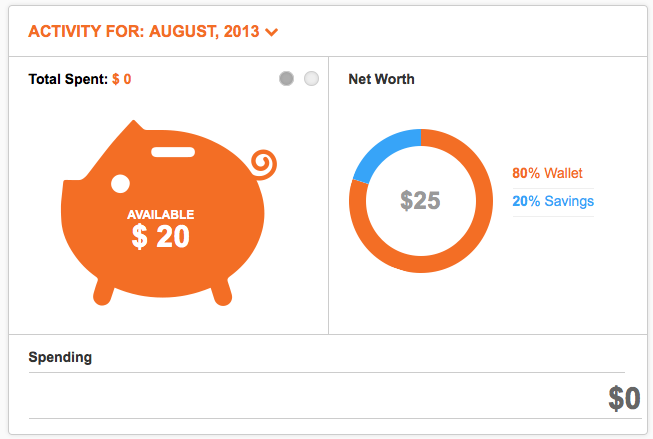

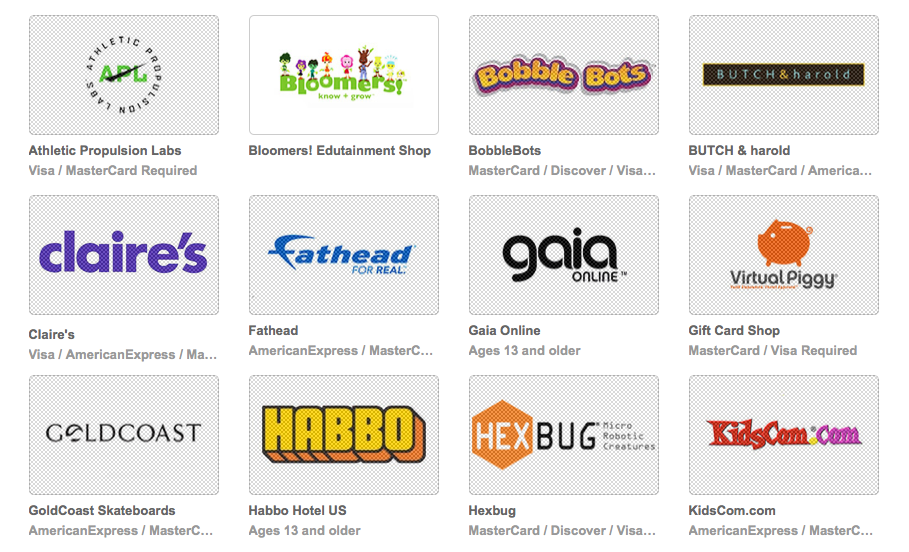

Now, you are ready to introduce Virtual Piggy to your child. My daughter logged in to see her dashboard and that I have transferred her previous allowance to her new Virtual Piggy account. She can now choose to put some of her money into the “Save” section and can reward herself by spending some of her allowance at Virtual Piggy connected stores.

Virtual Piggy has been a great way to open the conversation about financial responsibility with my 8 year old. And it is strengthening our “Ping Pong Ball Reward System”, too!

How do you teach your kids the value of a dollar?

Love this program! Great way to teach kids about money.

NEAT! I’ll have to bookmark this for when it’s Miguel’s time to learn about saving… Thanks!

I have seen this program around and it sounds great for teaching kids the value of saving money.

I love the idea of giving children some financial responsibilities along with goals. Even in the real adult world, thats what we do when we want to make a big purchase.

I am going to have to check out this program. I think it is important to teach children about earning and saving money.